long island tax calculator

The sales tax jurisdiction name is New York City which may refer to a local government division. Sales Tax Calculator Sales Tax Table.

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Did South Dakota v.

. This is the total of state county and city sales tax rates. Ad Find Deals on turbo tax online in Software on Amazon. The December 2020 total local sales tax rate was also 8875.

4 beds 45 baths 4347 sq. 129 Long Island Bay Hot Springs AR 71913 1795000 MLS 22025577 Stunning NEW CONSTRUCTION on Lake Hamilton. Long Island City collects the maximum legal local sales tax.

The Long Island City sales tax rate is. Use our mortgage calculator below for your estimated monthly payment. Long Island Avg 4867 Search Gas Prices.

All numbers are rounded in the normal fashion. We built our mortgage calculator to crunch the numbers that matter the most to your estimated monthly mortgage paymentfrom how much you plan to put down to how long you wish to borrow. Overview of New York Taxes New York state has a progressive income tax system with rates ranging from 4 to 109 depending on taxpayers income level and filing status.

All Zip Codes in Long Island Virginia 24569. The minimum combined 2022 sales tax rate for Long Island California is. See How Much You Can Save With Our Free Tax Calculator.

Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 53 in Long Island Virginia. Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. Ad Enter Your Tax Information.

Distinctively stylish with contemp. Nassau County Tax Lien Sale. That means that your net pay will be 42787 per year or 3566 per month.

After a few seconds you will be provided with a full breakdown of the tax you are paying. Below you can find the general sales tax calculator for Long Island city for the year 2021. The County sales tax rate is.

This is a custom and easy to use sales tax calculatormade by non other than 360 Taxes. The current total local sales tax rate in Long Island City NY is 8875. Learn more about your NY UI rate here.

NY State Mortgage Tax Rates - Freedom Land Title Agency New York State Mortgage Tax Rates County Name County Rate Table For mortgages less than 10000 the mortgage tax is 30 less than the regular applicable rate. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The Long Island sales tax rate is.

On the first 11800 each employee earns New York employers also pay unemployment insurance of between 0525 and 7825. The minimum combined 2022 sales tax rate for Long Island City New York is. If you make 55000 a year living in the region of New York USA you will be taxed 12213.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Assessment Challenge Forms Instructions. Sales taxes for a city or county in New York can be as high as 475 meaning you could potentially pay a total of 875 sales tax for a vehicle in.

Ginsberg CPA 200 South Service Road Suite 202 Roslyn Heights NY 11577 Phone. Certain churches and non-profits are exempt from this payment. Enter your Amount in the respected text field Choose the Sales Tax Rate from the drop-down list.

Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction. Free Federal Filing for Everyone. The Long Island City sales tax rate is 45.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Please contact Freedom Land Title for an accurate title invoice. There is no applicable county tax.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. This is the total of state county and city sales tax rates. Simply plug in your purchase price interest rate annual taxes insurance and more to.

The 8875 sales tax rate in Long Island City consists of 4 New York state sales tax 45 Long Island City tax and 0375 Special tax. Maryland Salary Tax Calculator for the Tax Year 202223 You are able to use our Maryland State Tax Calculator to calculate your total tax costs in the tax year 202223. Get rates tables What is the sales tax rate in Long Island California.

This is the total of state county and city sales tax. For tax preparation accounting services in Suffolk County visit Weisman CPA the most trusted Long Island CPA firm. How to Challenge Your Assessment.

New York Unemployment Insurance. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to New York local counties cities and special taxation districts. Long island tax calculator Thursday March 17 2022 Edit.

All fees are subject to change. The California sales tax rate is currently. The minimum combined 2022 sales tax rate for Long Island City New York is.

Rules of Procedure PDF Information for Property Owners. Did South Dakota v. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Ad Use The Tax Calculator to Estimate Your Tax Refund or the Amount You May Owe The IRS. 8875 sales tax in Kings County 21400 for a 20000 purchase Clifton Park NY 7 sales tax in Saratoga County You can use our New York sales tax calculator to determine the applicable sales tax for any location in New York by entering the zip code in which the purchase takes place. To calculate the sales tax amount for all other values use our sales tax calculator above.

Calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income understand your tax liability Taxable income Tax rate Tax liability minus any additional tax withholdings Total annual income Tax liability All deductions Withholdings Your annual paycheck State payroll tax. Years of savings number of years for how long youll keep money in this account. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

See What Credits and Deductions Apply to You. If youre a new employer youll pay a flat rate of 3125. Your average tax rate is 222 and your marginal tax rate is 361.

The New York sales tax rate is currently. Use our income tax calculator to find out what your take home pay will be in North Carolina for the tax year. The County sales tax rate is.

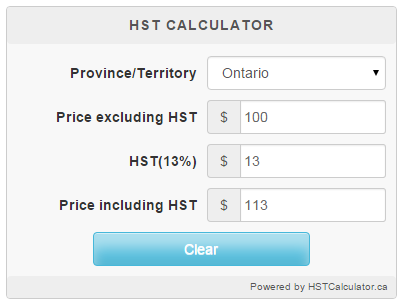

Wayfair Inc affect New York. To use our New York Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. How to use Long Island Sales Tax Calculator.

Canada Capital Gains Tax Calculator 2021 Nesto Ca

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Ontario Hst Calculator Hstcalculator Ca

New York Paycheck Calculator Smartasset

Long Island Cpa Accountant Www Abbelamarco Com Business Advisor Business Tax Tax Preparation

Ontario Property Tax Rates Calculator Wowa Ca

Tax Calculator Estimate Your Income Tax For 2022 Free

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Uber Tax Calculator Calculate Your Uber Estimate Hurdlr Uber Tax Uber Driver

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Tax Preparation Tax Services For Businesses In Long Island Estadounidenses Renunciar Ciudadania

Nyc Mansion Tax Calculator For Buyers Interactive Hauseit

Nyc Mansion Tax Calculator For Buyers Interactive Hauseit

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download